Forward-thinking CIOs and CTOs in the financial services sector have evolved. The increased competition from digital-only challenger banks has redefined customer expectations. While some traditional banks have been disrupted by the rise of fintech, others have advanced and prospered.

Tech-savvy bankers chose to adapt and transform the way they operate, in order to lower their operating costs and compete more effectively. The adoption of Artificial Intelligence (AI) and machine learning has been essential to their digital transformation, plus the use of Robotic Process Automation (RPA) platforms.

While many of these workflow optimizations are in the back-office processes, most also have a positive customer experience impact. Chatbots are being used to offer a better online user experience. Several banks also offer AI-based insights within their mobile banking apps, or AI-assisted investing via Robo-Advisors.

Fintech AI Market Development

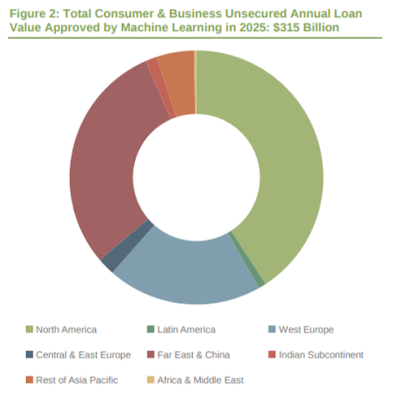

According to the latest worldwide market study by Juniper Research, the value of unsecured loans issued via AI underwriting platforms will reach $315 billion in 2025 -- that's up from just $24 billion in 2020.

Juniper found that consumer loans are driving overall AI-based lending use cases, and will account for 66 percent of loans by value underwritten by AI in 2025. When AI is combined with services such as Open Banking, it can build a comprehensive picture of financial status and anticipate future risks.

Tech-savvy bankers chose to adapt and transform the way they operate, in order to lower their operating costs and compete more effectively. The adoption of Artificial Intelligence (AI) and machine learning has been essential to their digital transformation, plus the use of Robotic Process Automation (RPA) platforms.

While many of these workflow optimizations are in the back-office processes, most also have a positive customer experience impact. Chatbots are being used to offer a better online user experience. Several banks also offer AI-based insights within their mobile banking apps, or AI-assisted investing via Robo-Advisors.

Fintech AI Market Development

According to the latest worldwide market study by Juniper Research, the value of unsecured loans issued via AI underwriting platforms will reach $315 billion in 2025 -- that's up from just $24 billion in 2020.

This significant growth of more than 1,200 percent over the next five years will be driven by banks and other lenders seeking to leverage AI to rebuild and streamline their lending operations, following the dramatic impact of the pandemic.

Juniper analysts identified that lenders will train their AI algorithms, in order to more accurately assess and mitigate the loan risks that some consumers and business customers may represent. This will enable lenders to build more sustainable lending models, in the wake of unprecedented economic turbulence.

Juniper analysts identified that lenders will train their AI algorithms, in order to more accurately assess and mitigate the loan risks that some consumers and business customers may represent. This will enable lenders to build more sustainable lending models, in the wake of unprecedented economic turbulence.

Juniper found that consumer loans are driving overall AI-based lending use cases, and will account for 66 percent of loans by value underwritten by AI in 2025. When AI is combined with services such as Open Banking, it can build a comprehensive picture of financial status and anticipate future risks.

Juniper analysts recommend that consumer and commercial lenders leverage these AI technology capabilities to expand their customer portfolios, post-pandemic, to those without detailed credit files.

"Expanding lending operations into untapped areas of the market is a critical way in which banks can not only increase their own revenue but also compete more effectively with rival fintech services," said George Crabtree, an analyst at Juniper Research.

"Expanding lending operations into untapped areas of the market is a critical way in which banks can not only increase their own revenue but also compete more effectively with rival fintech services," said George Crabtree, an analyst at Juniper Research.

Outlook for Robo-Advisor Applications Growth

The research also found that robo-advisors, where AI actors manage investments for users, will account for over $3 trillion in assets under management in 2025, from $500 billion in 2020.

The research also found that robo-advisors, where AI actors manage investments for users, will account for over $3 trillion in assets under management in 2025, from $500 billion in 2020.

According to the Juniper assessment, rather than selling services directly to users, robo-advisor vendors should partner with large banks. This enables robo-advisors to access large groups of potential users who are underserved by current wealth management propositions -- growing revenue while keeping customer acquisition costs low.

Furthermore, I believe that financial services' digital transformation will drive more merger and acquisition activity as the global market leaders accelerate past the legacy institutions that are unable to adapt and embrace new digital growth strategies. That said, the global pandemic creates many new challenges and opportunities for all organizations to reimagine their current business model.