Senior executives in the world’s largest and most complex organizations will develop the insights required to achieve lasting Digital Transformation. Gartner has identified a model for digital business growth that binds together data, analytics, technology, and forward-looking transformation capabilities.

The Gartner Research Board said that data and analytics (D&A) leaders are uniquely positioned to drive this strategic organizational change that will make their companies behave like 'digital native' leaders.

"The most advanced and successful D&A leaders are driving new opportunities to use digital capabilities – often data and analytics products – to capture value. Those opportunities should directly connect to the business priorities," said Mario Faria, vice president at Gartner.

Digital Business Market Development

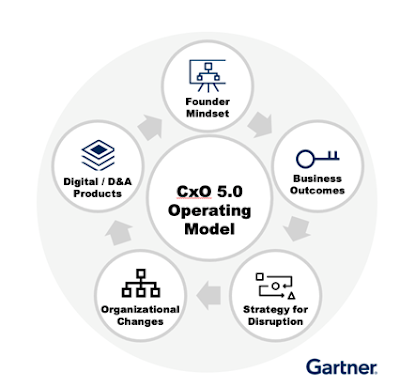

At the same time, some leaders are using digital and D&A to create whole new business models. These leaders – which Gartner named the CxO 5.0 – are helping businesses reconstitute by adopting an operating model that grafts native digital capability onto their existing non-digital native businesses.

"After we identified how the most successful companies are doing digital reconstitution well, we worked with their CDAOs to create a blueprint of the operating model for others to use, and a maturity tool to identify where a company is on their CxO 5.0 journey," said Tom Stanton, director at Gartner.

Gartner's CxO 5.0 operating model is based on the idea of grafting, where D&A leaders bring to their companies a way to behave and act like digital natives using five core components.

The Five Core Components of CxO 5.0

Founder Mindset: A founder mindset prioritizes solving a problem with minimal waste. When mapping out a strategy, a founder mindset means aligning roles and responsibilities clearly with goals, objectives, and incentives clearly explained.

Business Outcomes: Organizations should have a clear business strategy with defined alignment to their digital strategy. Leaders should communicate the purpose of data as a service to the whole enterprise. To be a data-driven organization, everyone must own the data and a culture of accountability and alignment must be fostered.

Strategy for Disruption: To identify disruption, organizations should operate under the mindset that someone else is already working on a better way. Use data to help create the strategy. Do not use data to try to prove your strategy. CxOs should leverage their strength across the organization for scalability and have the courage to change or cut ties with people, processes, and relationships that do not align.

Organizational Changes: The goal is to encourage a more decentralized organizational structure that allows for the infusion of skills across the business. To do that, the CxO should start building an organization that is resilient to frequent people changes and learn how to take advantage of it, such as incorporating on-the-job learning to break down silos.

Digital D&A Products: Organizations should try to enable operations in real-time from resources to insights and create a shift to consistent cross-communication. This means moving to a multi-cloud or cloud-agnostic strategy by looking at the process and methodology needs to select the platform and build out detailed procedures based on the platform’s capabilities.

Outlook for Digital Business Growth Innovation

According to the Gartner assessment, this methodology will provide the ability to evolve and discover new products or services enabling growth via data-driven insights. Gartner analysts say that Chief Data and Analytics Offices (CDAO) should focus on these advantages to help drive digital capabilities.

That said, I believe digital business growth innovation requires savvy leaders to think beyond the current status quo processes within their organization. As an example, a forward-thinking C-suite will nurture a belief that economic volatility is actually an upside opportunity for net-new growth.

Digital transformation requires bold and brave leadership. While the legacy leader responds to disruptions in predictable ways, the most innovative organizations will seek new digital 'white space' to accelerate past the laggards who cling to the past and reject change management best practices.