Online payment solution development continues to evolve. To date, blockchain has had a mixed impact across payments and banking, but the rise of Stablecoin and Central Bank Digital Currency (CBDC) will accelerate the impact.

Fundamentally, Stablecoins and CBDCs are two ways of solving the same inherent problem -- how to offer a better and more trusted digital payments solution.

To date, most existing payment types have been designed around traditional systems intended for in-person or telephone payments, such as credit cards, or even cash.

Therefore, Stablecoins and CBDCs are providing a system that's a significant payment use case transformation.

Digital Payment Market Development

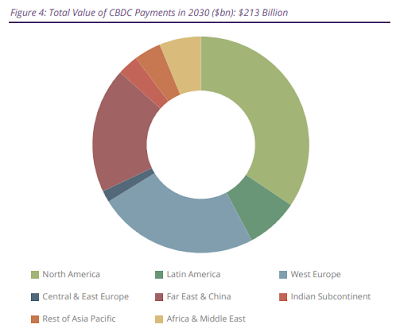

According to the latest worldwide market study by Juniper Research, the value of payments via CBDCs will reach $213 billion annually by 2030 -- that's up from just $100 million in 2023.

However, this significant market growth opportunity of over 260,000 percent reflects the early stage of the sector, which is currently limited to several Fintech pilot projects.

According to the Juniper assessment, adoption will be driven by governments leveraging CBDCs to boost financial inclusion and increase their control over how digital payments are made.

CBDCs will improve access to digital payments, particularly in emerging economies; where mobile phone penetration is significantly higher than traditional banking penetration.

A CBDC is a digital coin issued by a nation's central bank, pegged to the country’s fiat currency -- for example, the government‑issued physical paper and coin money.

The research found that by 2030, 92 percent of the total value transacted via CBDCs will be paid domestically. This reflects a change from almost 100 percent during the current pilot stages, as of 2023.

Since CBDCs are issued by central banks, they will be closely targeted to domestic payment challenges initially, with cross-border payments coming later, as systems become established and links are made between CBDCs used by individual countries.

"While cross-border payments currently have high costs and slow transaction speeds, this area is not the focus of CBDC development," said Nick Maynard, head of research at Juniper Research.

As CBDC adoption will be very country-specific, it will be incumbent on cross-border payment networks to link schemes together; allowing the wider payments industry to benefit from CBDCs.

Over time, that's the larger upside opportunity for growth.

Outlook for Digital Payment Apps Growth

The research findings also identified a lack of commercial product development around CBDCs as a key limiting factor for the current market, with few well-defined app platforms for central banks to leverage.

Juniper analysts recommend that prospective CBDC platform providers develop a full end-to-end solution, including wholesale capabilities, wallet provision and merchant acceptance, in order to enable the realization of CBDCs’ full potential.

That said, I believe that solution credibility will drive growth. Standardization is critical in order for stablecoins and CBDCs to gain momentum -- the underlying systems must be trusted and then a user need not know how the payment is being processed.

Furthermore, the simplicity of digital payment processing is important and a key to new payment methods entering into the broader financial services market. This is an essential component for success.