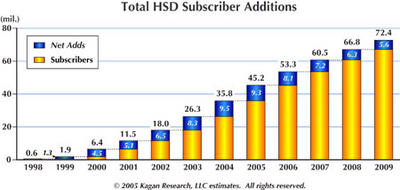

Kagan Research published a report predicting the growth in new high-speed data (HSD) customer additions for cable operators in the U.S. will crest in 2005, but the continued migration of dial-up customers promises expansion for the industry. Kagan forecasts cable modem subscribers will top 38 million by 2009, amid intense competition from DSL providers. Report highlights include:

* Cable currently dominates the HSD market with approximately 60 percent market share. Kagan projects that will shrink to 53 percent by 2009, with telco providers growing share from 35 percent in 2001 to 40 percent in 2009.

* The average recurring monthly revenue from a cable sub is more than $41, leading to a total annual revenue of $9.5 billion. in 2004. The average recurring monthly revenue from the average DSL sub at $32 generated annual revenues of $5.76 billion. in 2004.

* BellSouth at the end of 2004 had the highest penetration of DSL subscribers to total access lines at 9.8 percent. With an estimated 16.9 percent penetration of DSL subscribers on primary access lines, BellSouth was second only to SBC's 22 percent.