In the late 1980s, fresh network TV series that previously landed in TV syndication for their second window began flowing to basic cable networks -- a new media of that era. "Now downloads are the new media for network series," says Bridget McCullough, associate analyst at Kagan Research. "Mobile TV will be next."

Welcome to a world of old media, new media and the newer new media. The plain vanilla new media encompasses video on demand, direct broadcast satellite TV and Internet advertising, all about a decade old. A generational gap appears between them and the "newer" mobile TV, advertisements in video games, wireless/WiFi broadband and mobile TV.

"In a general line of demarcation, the newer new media are mobile and offer personalization in which consumers control delivery," notes McCullough. "This is in contrast to the traditional 'push' model in which old media publishes content once on its schedule."

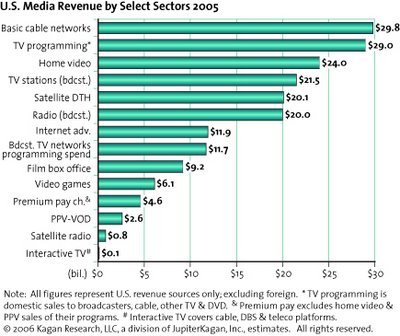

The old media, including broadcast stations, newspaper and magazines, may be old and slow growing, but they are not to be dismissed lightly. In lining up these media by revenue, old media is more impressive in terms of size, while the new and newer media has the sizzle of rapid proportional growth.

The possibilities for interactive TV stir the imagination, but it still was a relatively meager $100 million revenue business in 2005, versus $29 billion for regular TV programming. Old, new and newer media constantly collide. Newspapers endured a drain in advertising to first generation Internet Web sites and search engines, but are now in the Web site business themselves.