With profit margins under pressure, most telecom service providers are already considering dramatic cost reduction plans in the new year, such as the immediate adoption of open source software and the piloting of SDN or NFV projects.

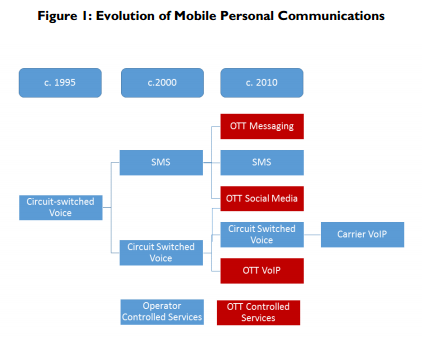

In particular, mobile service providers are most at risk. This is why they are in the process of evolving their business model -- primarily, in response to the latest global trends in mobile personal communications.

Juniper Research has found that with combined annual mobile network operator expenditures now in excess of $800 billion, several leading service providers face the possibility of costs exceeding revenues by the end of the decade without remedial action.

According to their latest worldwide market study, a combination of flat revenues from traditional services combined with surging data traffic costs could ultimately threaten the viability of all mobile network operations.

In an analysis of 12 international mobile network operators, Juniper found that profit margins had fallen by an average of 6.4 percent over a three year period, with 5 of those surveyed experiencing decreasing margins in every year throughout the period.

Furthermore, a number of major mobile network operators now have single figure margins -- with costs currently increasing at 1.5-2 percent per year, the situation is unsustainable in the longer term.

Meanwhile, the Juniper study found that without more widespread network optimization and the implementation of other cost controls, the situation could become critical in a number of developing markets.

Juniper believes that with surging mobile Internet adoption in the Indian Subcontinent, regional operators could see data costs outstrip data revenues by $45 billion within 3 years unless networks are fully optimized.

However, they also pointed to a number of success stories, particularly in the U.S. market, where service providers such as Verizon and AT&T have bucked the trend in falling margins by introducing shared data plans.

It observed that Verizon had seen wireless revenues increasing by more than 7 percent despite operating in a saturated market, while AT&T now had more than 14 million households on shared plans.

That said, service providers need a comprehensive strategy to adapt their current business model to the realities of the disruptive changes in the marketplace. Pricing plans aren't a long-term solution to the apparent challenges.

"Given the threat from Over-The-Top (OTT) VoIP and messaging services to core service revenue, the U.S. emphasis on focusing the value on the data element is absolutely the right way to go. This is particularly true within an increasingly 4G environment," said Dr. Windsor Holden, head of consultancy and forecasting at Juniper Research.

In particular, mobile service providers are most at risk. This is why they are in the process of evolving their business model -- primarily, in response to the latest global trends in mobile personal communications.

Juniper Research has found that with combined annual mobile network operator expenditures now in excess of $800 billion, several leading service providers face the possibility of costs exceeding revenues by the end of the decade without remedial action.

According to their latest worldwide market study, a combination of flat revenues from traditional services combined with surging data traffic costs could ultimately threaten the viability of all mobile network operations.

In an analysis of 12 international mobile network operators, Juniper found that profit margins had fallen by an average of 6.4 percent over a three year period, with 5 of those surveyed experiencing decreasing margins in every year throughout the period.

Furthermore, a number of major mobile network operators now have single figure margins -- with costs currently increasing at 1.5-2 percent per year, the situation is unsustainable in the longer term.

Meanwhile, the Juniper study found that without more widespread network optimization and the implementation of other cost controls, the situation could become critical in a number of developing markets.

Juniper believes that with surging mobile Internet adoption in the Indian Subcontinent, regional operators could see data costs outstrip data revenues by $45 billion within 3 years unless networks are fully optimized.

However, they also pointed to a number of success stories, particularly in the U.S. market, where service providers such as Verizon and AT&T have bucked the trend in falling margins by introducing shared data plans.

It observed that Verizon had seen wireless revenues increasing by more than 7 percent despite operating in a saturated market, while AT&T now had more than 14 million households on shared plans.

That said, service providers need a comprehensive strategy to adapt their current business model to the realities of the disruptive changes in the marketplace. Pricing plans aren't a long-term solution to the apparent challenges.

"Given the threat from Over-The-Top (OTT) VoIP and messaging services to core service revenue, the U.S. emphasis on focusing the value on the data element is absolutely the right way to go. This is particularly true within an increasingly 4G environment," said Dr. Windsor Holden, head of consultancy and forecasting at Juniper Research.