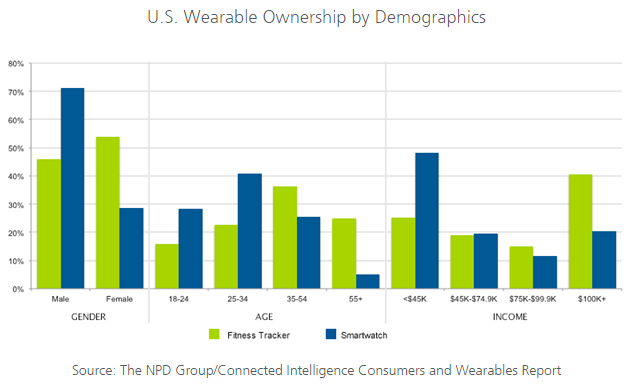

User demand for wearable devices has distinct demographic segments. Age, income, and gender vary greatly among fitness tracker and smartwatch owners, according to the latest American market study by NPD Group.

Purpose-built fitness trackers, which have a strong presence in the wearables market, have gained a large mainstream following.

According to their study, 36 percent of fitness tracker owners in the U.S. market are 35-54 years old, 41 percent had an average income of more than $100,000, and 54 percent were women.

Moreover, one-in-ten U.S. adults now own a fitness tracker.

Smartwatches haven’t caught on as quickly, with only two percent penetration, and appeal to a much different segment of the market.

More than two-thirds (69 percent) of smartwatch owners are 18-34 years old, skew mostly towards the male population (71 percent) and nearly half (48 percent) had an income below $45,000.

"There is no average consumer for the wearables market; the fitness tracker and smartwatch target consumer are fundamentally different,” said Wes Henderek, director connected intelligence at NPD Group.

NPD believes that while they expect smartwatch ownership to grow more rapidly over the next year, there will remain a clear place for the fitness tracker due to its size, battery life, and focus on one specific use case -- as opposed to the smartwatch which is trying to be a little bit of everything for everyone.

The Consumers and Wearables report from NPD is delivered twice a year as part of the Connected Intelligence WEAR practice. The report is based on a survey of 5,000 U.S. consumers, age 18 and older that was completed in December 2014.

This information was then calibrated against life-to-date unit sales of wearable devices from the NPD Retail Tracking Service, as well as Civic Science results relating to wearable device ownership.

Purpose-built fitness trackers, which have a strong presence in the wearables market, have gained a large mainstream following.

According to their study, 36 percent of fitness tracker owners in the U.S. market are 35-54 years old, 41 percent had an average income of more than $100,000, and 54 percent were women.

Moreover, one-in-ten U.S. adults now own a fitness tracker.

Smartwatches haven’t caught on as quickly, with only two percent penetration, and appeal to a much different segment of the market.

More than two-thirds (69 percent) of smartwatch owners are 18-34 years old, skew mostly towards the male population (71 percent) and nearly half (48 percent) had an income below $45,000.

"There is no average consumer for the wearables market; the fitness tracker and smartwatch target consumer are fundamentally different,” said Wes Henderek, director connected intelligence at NPD Group.

NPD believes that while they expect smartwatch ownership to grow more rapidly over the next year, there will remain a clear place for the fitness tracker due to its size, battery life, and focus on one specific use case -- as opposed to the smartwatch which is trying to be a little bit of everything for everyone.

The Consumers and Wearables report from NPD is delivered twice a year as part of the Connected Intelligence WEAR practice. The report is based on a survey of 5,000 U.S. consumers, age 18 and older that was completed in December 2014.

This information was then calibrated against life-to-date unit sales of wearable devices from the NPD Retail Tracking Service, as well as Civic Science results relating to wearable device ownership.