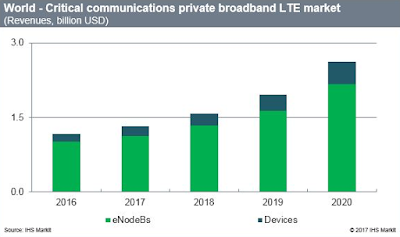

Wireless communications sector continues a global expansion. The broadband 4G LTE market is forecast to grow at a compound annual growth rate (CAGR) of 20 percent, from $1.1 billion in 2015 to reach $2.6 billion in 2020, according to the latest worldwide market study by IHS Markit.

The total addressable market for private LTE is compounded by increasing revenues from both devices and evolved Node Bs (eNBs) shipped for use on private networks that are based on wireless cellular technology.

Demand has increased for data alongside voice communications within a range of applications. The broadband market is opening up to multiple sectors -- such as public safety and security, transportation, military, utilities, industrial and public access mobile radio.

Private LTE Market Development

Mobile communication users are now requiring high bandwidth solutions to facilitate applications such as video streaming, internet access and advanced mapping use cases.

"Broadband-capable technologies can provide these tools because of their ease of interoperability and high performance. As a result, the industry requires broadband-capable network solutions such as private LTE or other operating models possible with commercial and private LTE," said Jesus Gonzalez, analyst at IHS Markit.

For critical communications users today, it is clearer than ever that LTE is the de facto broadband standard, with the option of private LTE networks a reality. Initial deployments of private cellular networks have been small in scale and varied across several sectors -- many are trial systems used by public safety groups.

There are some very specific regional trends in terms of early deployments, with evidence of systems deployments across China, the Middle East, the United States, Western Europe, and Australia, among others.

Moreover, with the possibility of spectrum allocation in other parts of the world, the market for private LTE cellular systems for PMR users will expand, according to the IHS Markit assessment.

Meanwhile, the rollout of FirstNet continues to be a difficult task. It is important to consider all factors affecting it, particularly in public safety, including funding, cooperative partnerships, end-user perspectives and legislation.

Outlook for Private LTE Deployments

IHS Markit remains optimistic about the FirstNet network, expecting that from 2020 onwards, scalable deployments on the network will begin. As a result, the U.S. market will become a main driver of global private LTE revenues.

The Middle East and Africa (MEA) region has had the fastest growth rate of installed base of private LTE users, but the Asia Pacific region will continue to have the greatest share of the world private LTE users installed base in the upcoming years.

The total addressable market for private LTE is compounded by increasing revenues from both devices and evolved Node Bs (eNBs) shipped for use on private networks that are based on wireless cellular technology.

Demand has increased for data alongside voice communications within a range of applications. The broadband market is opening up to multiple sectors -- such as public safety and security, transportation, military, utilities, industrial and public access mobile radio.

Private LTE Market Development

Mobile communication users are now requiring high bandwidth solutions to facilitate applications such as video streaming, internet access and advanced mapping use cases.

"Broadband-capable technologies can provide these tools because of their ease of interoperability and high performance. As a result, the industry requires broadband-capable network solutions such as private LTE or other operating models possible with commercial and private LTE," said Jesus Gonzalez, analyst at IHS Markit.

For critical communications users today, it is clearer than ever that LTE is the de facto broadband standard, with the option of private LTE networks a reality. Initial deployments of private cellular networks have been small in scale and varied across several sectors -- many are trial systems used by public safety groups.

There are some very specific regional trends in terms of early deployments, with evidence of systems deployments across China, the Middle East, the United States, Western Europe, and Australia, among others.

Moreover, with the possibility of spectrum allocation in other parts of the world, the market for private LTE cellular systems for PMR users will expand, according to the IHS Markit assessment.

Meanwhile, the rollout of FirstNet continues to be a difficult task. It is important to consider all factors affecting it, particularly in public safety, including funding, cooperative partnerships, end-user perspectives and legislation.

Outlook for Private LTE Deployments

IHS Markit remains optimistic about the FirstNet network, expecting that from 2020 onwards, scalable deployments on the network will begin. As a result, the U.S. market will become a main driver of global private LTE revenues.

The Middle East and Africa (MEA) region has had the fastest growth rate of installed base of private LTE users, but the Asia Pacific region will continue to have the greatest share of the world private LTE users installed base in the upcoming years.