The Global Networked Economy is fueled by the growing adoption and application of digital commerce innovations. In many instances, digital commerce enables wholesale supplier or retailer customers to purchase goods and services through an interactive and self-service experience.

It includes the people, processes and technologies to execute the offering of development content, analytics, promotion, pricing, customer acquisition and retention, and customer experience at all touchpoints throughout the customer buying journey. That's one view of the evolving eCommerce landscape.

Digital Commerce Market Development

Industry analysts also segment the overall digital commerce market into payments, banking and gambling as its principal segments, which are then further broken down into their respective sub-segments.

It's important to appreciate that these segments are not mutually exclusive and necessarily intersect with one other to varying extents. Boundaries between the segments are not always binary in the reality of the global marketplace and the associated services being delivered.

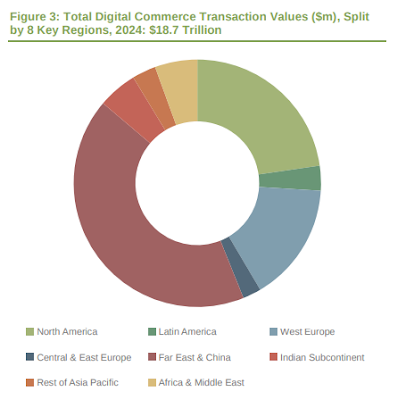

According to the latest worldwide market study by Juniper Research, global spending on digital commerce will reach $18.7 trillion by 2024 -- that's up from $11.2 trillion in 2019; an increase of 66 percent over the 5-year forecast period.

The new study found the largest single digital commerce sector is the remote purchase of physical goods, which will have driven just under 27 percent of all digital commerce spend by the end of 2019.

The eCommerce market is being accelerated by digital-native merchants and a renewed focus from traditional brick and mortar retailers, who are offering differentiated omnichannel experiences in order to secure future revenue streams.

Juniper analysis highlighted the user experience via digital channels as the crucial next battleground for retailers. Reduced friction in the checkout process, despite increased security requirements, is an essential ingredient for future success.

The data that Juniper gathered found that digital money transfer is one of the main drivers for increasing digital commerce spend -- forecast to grow by 85 percent over the next 5 years.

Juniper also identified domestic money transfer as a critical element, with increased activity in emerging markets a key contributor to the overall market value.

"Domestic money transfer is being heavily disrupted, with mobile-first services displacing the traditional role of cash in emerging economies. Partnerships with international merchants and wallets will enable these markets to participate in eCommerce on a scale previously thought impossible," said Nick Maynard, lead analyst at Juniper Research.

Outlook for Digital Commerce Applications Growth

The research also found that payments from IoT devices, primarily in the smart home and via connected vehicles, will reach over 32 billion transactions by 2024. This compares with just under 1.8 billion transactions in 2019, as these new channels achieve customer recognition and acceptance.

However, the research also predicted that these new channels will not represent new consumer spend; they will largely be driven by migration from traditional payment card spend or will cannibalize other digital channels.

It includes the people, processes and technologies to execute the offering of development content, analytics, promotion, pricing, customer acquisition and retention, and customer experience at all touchpoints throughout the customer buying journey. That's one view of the evolving eCommerce landscape.

Digital Commerce Market Development

Industry analysts also segment the overall digital commerce market into payments, banking and gambling as its principal segments, which are then further broken down into their respective sub-segments.

It's important to appreciate that these segments are not mutually exclusive and necessarily intersect with one other to varying extents. Boundaries between the segments are not always binary in the reality of the global marketplace and the associated services being delivered.

According to the latest worldwide market study by Juniper Research, global spending on digital commerce will reach $18.7 trillion by 2024 -- that's up from $11.2 trillion in 2019; an increase of 66 percent over the 5-year forecast period.

The new study found the largest single digital commerce sector is the remote purchase of physical goods, which will have driven just under 27 percent of all digital commerce spend by the end of 2019.

The eCommerce market is being accelerated by digital-native merchants and a renewed focus from traditional brick and mortar retailers, who are offering differentiated omnichannel experiences in order to secure future revenue streams.

Juniper analysis highlighted the user experience via digital channels as the crucial next battleground for retailers. Reduced friction in the checkout process, despite increased security requirements, is an essential ingredient for future success.

The data that Juniper gathered found that digital money transfer is one of the main drivers for increasing digital commerce spend -- forecast to grow by 85 percent over the next 5 years.

Juniper also identified domestic money transfer as a critical element, with increased activity in emerging markets a key contributor to the overall market value.

"Domestic money transfer is being heavily disrupted, with mobile-first services displacing the traditional role of cash in emerging economies. Partnerships with international merchants and wallets will enable these markets to participate in eCommerce on a scale previously thought impossible," said Nick Maynard, lead analyst at Juniper Research.

Outlook for Digital Commerce Applications Growth

The research also found that payments from IoT devices, primarily in the smart home and via connected vehicles, will reach over 32 billion transactions by 2024. This compares with just under 1.8 billion transactions in 2019, as these new channels achieve customer recognition and acceptance.

However, the research also predicted that these new channels will not represent new consumer spend; they will largely be driven by migration from traditional payment card spend or will cannibalize other digital channels.