Mobile channels are increasingly important for enterprises to connect with employees, business partners, and customers, with telecom service providers emerging that offer a comprehensive platform that enables the management of this essential tool. Plus, they're now frequently cloud-based solutions.

These solutions are collectively known as Communications Platform-as-a-Service (CPaaS) offerings.

There are a number of services that can be considered part of CPaaS platforms, including messaging technologies such as SMS, Rich Communication Services (RCS), and Over-the-Top (OTT) messaging applications. Also offered are push notifications, digital voice services, and email.

CPaaS Market Development

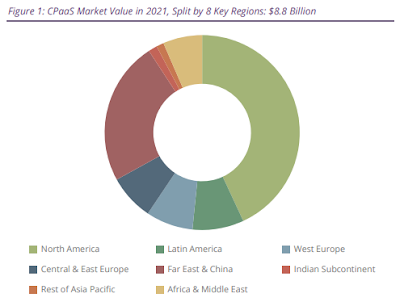

According to the latest market study by Juniper Research, CPaaS revenue generated within the North American marketplace will reach $15 billion by 2026 -- that's rising from $3.7 billion in 2021.The study found that significant demand for mobile channels -- such as SMS and mobile voice -- from enterprises has created a highly attractive market for CPaaS vendors and service providers. CPaaS platforms offer a centralized service for outbound communications.

The research findings predict that this growth will drive investment from leading CPaaS vendors into the North American region. In turn, the region is anticipated to represent 45 percent of global CPaaS market value by 2026, despite only accounting for 5 percent of global mobile phone subscribers.

Juniper research analysts urge CPaaS platform providers to invest in AI-based conversational messaging functionality to capitalize on this emerging growth.

They anticipate that enabling mobile subscribers to buy digital and physical goods through the native mobile messaging app client will further increase the appeal of a vendor’s CPaaS solutions.

CPaaS vendors must attempt to benefit from the growth of mobile messaging via revenue-sharing agreements that allocate a proportion of commerce sales to their platforms as revenue.

CPaaS vendors must attempt to benefit from the growth of mobile messaging via revenue-sharing agreements that allocate a proportion of commerce sales to their platforms as revenue.

In order to maximize this new revenue-generating channel, Juniper suggests that CPaaS vendors prioritize the onboarding of key eCommerce retailers in the U.S. market and ensure that payment details are stored securely.

According to the Juniper assessment, as CPaaS services become increasingly competitive in North America, leading vendors and service providers will look to capitalize on future growth in the Asia-Pacific region.

Outlook for CPaaS Enterprise Applications Growth

Juniper has forecast that revenue in this key region will rise from $2.2 billion in 2021 to over $9 billion by 2026 -- that's representing a growth of over 300 percent during the next 5 years.

"North America represents an immediate opportunity for CPaaS vendor growth, but long-term growth strategies will require vendors to invest their operations in other regions, as North America becomes saturated," said Sam Barker, head of analytics and forecasting at Juniper Research.

"North America represents an immediate opportunity for CPaaS vendor growth, but long-term growth strategies will require vendors to invest their operations in other regions, as North America becomes saturated," said Sam Barker, head of analytics and forecasting at Juniper Research.

That said, I recall the early development of CPaaS offerings and the relatively limited enterprise use cases at that time. In the past, most business communications were enabled by an on-premises telecom infrastructure investment. Today, that approach is the exception in most forward-looking organizations.

Everything-as-a-Service now includes comprehensive business communication capabilities. This market has significant upside growth potential as more organizations embrace a distributed workforce model and many knowledge workers and front-line employees are enabled to perform their job from anywhere.