The number of mobile communication subscriptions worldwide is currently estimated at 8 billion, with 6 billion on smartphone connections, from a user base of 5.9 billion unique subscribers among a global population of 7.9 billion.

Fifth-generation (5G) mobile service subscriptions using a compatible device significantly grew during the COVID-19 pandemic, but 4G connections remain the dominant force within the global telecom service provider sector.

While the use of mobile phones is common throughout developing nations, 4G services are still an emerging technology in many parts of the world. Overall, 5G subscriptions will likely grow from 580 million at the end of 2021 to 3.5 billion by the end of 2026.

5G Mobile Market Development

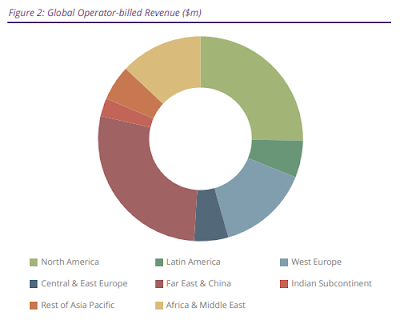

According to the latest worldwide market study by Juniper Research, revenue generated from 5G mobile services will reach $600 billion by 2026 -- representing 77 percent of global network operator-billed revenue.

The adoption of 5G services across consumer and IoT sectors has been driven by a strong uptake of 5G-capable devices, coupled with attractive 5G subscription pricing models -- that's despite the semiconductor crisis caused by the COVID-19 pandemic.

Juniper analysts urge mobile operators to leverage their 5G networks and high levels of virtualization to develop new IP‑based services that generate additional revenue streams. They've identified emerging 5G-based consumer devices, such as laptops and mobile routers, as a key area of focus over the next few years.

Juniper also anticipated that, as geographical 5G coverage expands, network operators will capitalize on revenue streams beyond smartphone devices. They recommend bundling multiple device subscriptions under a single recurring payment to enable service providers to benefit from all device revenue.

"Device vendors are capitalizing on faster networks to add mobile connectivity to new consumer devices, and operators must respond by enabling users to access 5G across multiple devices under a single subscription; allowing subscribers to conveniently manage data," said Charles Bowman, industry analyst at Juniper Research.

Juniper forecasts that the amount of cellular data generated will reach 2,900 exabytes by 2026 -- that's rising from 720 exabytes in 2021. This represents a growth of 300 percent over the next five years.

Outlook for 5G Mobile Applications Growth

Juniper analysts also predict that this growth will be driven by increasing demand for mobile data services over 5G connections and substantial growth in cellular Internet of Things (IoT) devices.

According to the Juniper assessment, Cellular IoT devices -- including smart city devices, smart home sensors, and connected agriculture -- will grow substantially over the next five years.

By 2026, the market study findings predict that the number of cellular IoT devices will reach 6 billion -- thereby exceeding the global number of smartphones for the first time.

That said, I believe 5G mobile network operators will increase their marketing efforts in the coming weeks and months of 2022 as the consumer and business demand grows rapidly across the globe.