Digital identity is constantly evolving and increasingly combined with allied areas, such as online security, privacy, and the management of identity-related data. Digital identity is essentially an online persona of a subject, or a unique representation of a subject, engaged in an online transaction.

However, digital identity presents a more complex picture when current multi-use ecosystems that are heavily dependent on the sharing of identity credentials are considered. Such an identity is made up of identifiers and patterns that are unique to the subject of identity, which is broadly described as attributes.

These attributes (inherent or ascribed) are core biographic data (e.g. name and address) and certain biometric features (e.g. fingerprints, iris scan) electronically captured in the context of personal digital identity.

Digital Identity Market Development

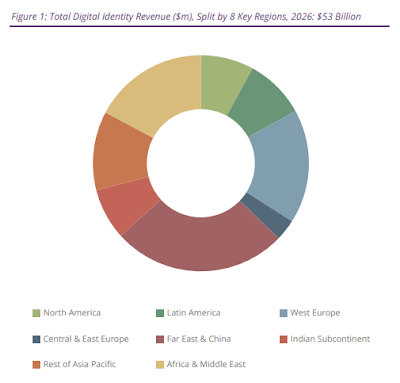

According to the latest worldwide market study by Juniper Research, revenue for digital identity vendors will exceed $53 billion globally in 2026 -- that's doubling from $26 billion in 2021.

Digital identity revenue includes third-party and civic identity apps, centralized identity services, and digital identity verification. Juniper analysts predict that the increased demand for digital onboarding frameworks in the face of the ongoing pandemic will accelerate the uptake of digital identity services.

Juniper also identified verified digital identity, where identities are confirmed as genuine using verifiable credentials, as being vital for improving fraud mitigation.

Juniper also identified verified digital identity, where identities are confirmed as genuine using verifiable credentials, as being vital for improving fraud mitigation.

This represents the next evolutionary step for digital identity -- moving from establishing infrastructure to utilizing and verifying identity in practical applications.

To facilitate this, Juniper analysts have predicted increasing data partnerships between IT solution vendors that provide comprehensive, data-diverse identity systems and services.

The study found that verification spending will exceed $16 billion in 2026, up from $9 billion in 2021. This growth reflects that, as users migrate to digital channels, the need to verify identity digitally also grows.

According to the Juniper assessment, as more fraudsters exploit online theft opportunities, verification capabilities will likely proliferate to a wider selection of key industry applications and use cases.

"Digital identity verification tools have become more critical across a broader range of industries than ever, from banking and financial services to eGovernment, healthcare and others," said Damla Sat, research analyst at Juniper Research. "Developing effective user experiences for different verification scenarios will be important for realizing digital identity’s potential."

"Digital identity verification tools have become more critical across a broader range of industries than ever, from banking and financial services to eGovernment, healthcare and others," said Damla Sat, research analyst at Juniper Research. "Developing effective user experiences for different verification scenarios will be important for realizing digital identity’s potential."

Outlook for Digital Identity Applications Growth

The research study also uncovered that the United States is significantly lagging behind in digital identity terms -- estimated to account for only 7 percent of global digital identity revenue in 2026.

The U.S. market's lack of a national identity program and coordinated strategies is a major limiting factor. However, Juniper has recognized the potential for decentralized identity in America and recommends vendors focus on private initiatives to realize the full digital identity upside in this market.

That said, I anticipate to unlock the full potential market value, individuals and institutions will need to broadly adopt and use digital ID technologies. Plus, adoption and usage will likely happen when the digital ID provides more value than the prior status quo, the user experience is positive, and the registration is easy.