Forward-looking leaders across the globe continue to apply digital transformation strategies for competitive advantage. The latest release of a regional IDC market study reveals that the recent acceleration in digital investments sets Asia-Pacific ahead of the rest of the world.

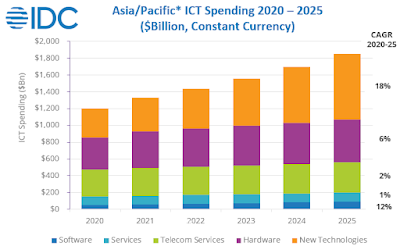

Investments in new technologies such as artificial intelligence (AI), robotics, Internet of Things (IoT), Augmented Reality (AR), Virtual Reality (VR), and blockchain are expected to contribute close to 40 percent of total ICT investments by the end of the forecast period from around 30 percent in 2020.

Digital Transformation Market Development

Compared to other regions in the world, this Asia-Pacific upside opportunity is the highest and represents close to 18 percent growth in dollar terms during the IDC forecast period of 2020-2025.

"The pandemic induced digital-first shift in the region led to increased investments in new technologies and will continue to do so in the foreseeable future," says Vinay Gupta, research director at IDC.

Enterprises that have realized the business gain will find it difficult to undo these initiatives. According to the IDC assessment, those still sitting on the sidelines will recognize that the world has moved on.

Traditional ICT spending on hardware, software, services, and telecom has two facets: revenue from legacy categories is stagnating or declining, while growth will come from cloud computing, mobile internet, big data analytics, and social media.

Savings secured by enterprises post deploying cloud services or data analytic solutions is reinvested in new technologies. In developing economies of the Asia-Pacific region, the story is a bit different.

Having skipped the earlier phase of technology investments, enterprises are now investing in these new technologies seeing the benefits gained by their peer group in developed economies.

New Technologies have seen accelerated acceptance due to the faster adoption of the digital journey. Organizations are now poised to take a chance to have a change or be the change for their customers.

IDC analysts believe that interaction and bundling within these technologies will be more effective for those forward-looking organizations in the future.

As per IDC's latest research, around 40 percent of Asia-Pacific enterprises report bringing operational efficiency and growing revenue as their two most important business priorities.

Thus, savvy enterprises have adopted new technologies such as IoT and robotics-specific use cases that deliver a rapid return on IT and communications infrastructure investments.

Outlook for Digital Transformation Applications Growth

IDC forecasts that IoT and robotics constitute around 80 percent of the new technology investment in the region. Driving IoT spending are use cases around manufacturing operations and production asset management.

Industrial robots used for monotonous but high precision tasks such as assembly, welding, and painting are witnessing increasing investments. Security-related to new technologies will continue to drive growth during the forecasted period.

That said, I foresee the growth of investment in business technologies that enable organizations to improve support for their distributed workforce. Moreover, organizations in the Asia-Pacific region have an opportunity to increase their remote professional service offerings for enterprise clients in the United States and Europe.