Today's cellular Internet of Things (IoT) services enable an upside opportunity for mobile network operators to leverage their infrastructure for a new revenue stream. This is most likely with 5G service launches, which were featured at MWC this week.

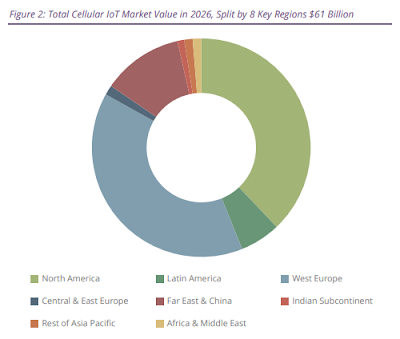

According to the latest worldwide market study by Juniper Research, the global value of the cellular IoT market will reach $61 billion by 2026 -- that's rising from $31 billion in 2022.

5G IoT Apps Market Development

The Juniper study identified the growth of 5G infrastructure and cellular Low-Power Wide Area (LPWA) technologies as key to this 95 percent increase in growth over the next four years.

The new study findings also expect carrier billing spend on content bundling to enable operators to further recoup investments into 5G by charging a premium to facilitate high-quality digital video and online game streaming over 5G cellular networks.

According to the Juniper assessment, in order to pursue this new opportunity, mobile network operators must offer payment services in markets underserved by existing digital payment methods to increase carrier billing.

Juniper analysts also urge network operators to migrate IoT connections that are currently on legacy networks to the more modern network infrastructure that supports the latest LPWA technologies.

It's anticipated that demand from enterprises for low-cost monitoring technologies -- enabled by LPWA networks -- will increase as these legacy networks are decommissioned over the next four years.

"Operators must educate users on the suitability of LPWA as a replacement technology for legacy networks. However, many IoT networks cannot solely rely on LPWA technologies. More comprehensive technologies, such as 5G, must underpin IoT network architectures and work in tandem with LPWA technologies to maximize the value of IoT services," said Charles Bowman, research analyst at Juniper Research.

Conversely, Juniper forecasts that 5G IoT services will generate $9 billion of revenue by 2026 -- that's rising from $800 million in 2021.

This upside potential represents a growth of 1,000 percent over the next five years as 5G coverage expands and mobile network operators benefit from the increased number of 5G IoT connections.

Outlook for 5G IoT Applications Growth

Juniper analysts now believe that the most effective way to capitalize on this growth is for network operators to offer value-added services -- such as network slicing and edge computing -- to IoT subscribers that could increase the level of 5G service adoption.

That said, I believe the growth of IoT use cases and the adoption of more devices have generated a significant amount of event data, most of which must be stored and analyzed. Moreover, where data is being transmitted in real-time, nearby edge computing resources will enable immediate processing.