Forward-thinking senior executives have taken their lessons learned from the COVID-19 pandemic and used them for much-needed changes to their business operations. They now include new flexible working models (for progressive employees), and newly redesigned office environments (for traditional employees).

Meanwhile, given the current business landscape, with rising costs for energy and a focus on reducing carbon emissions, increasing the level of automation in the remaining large metro office buildings will be a major priority.

That's a likely place where a Smart Building technology might help a retrospective CEO rationalize their status-quo 'return to office' plan. When combined with higher salaries and better employee benefits, that office experience could help to retain some essential talent that might otherwise resign.

Smart Building Market Development

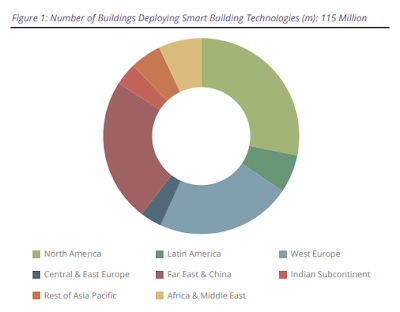

According to the latest worldwide market study by Juniper Research, the number of buildings globally deploying 'smart' technologies will reach 115 million in 2026 -- that's up from 45 million in 2022.

This growth of over 150 percent reflects increasing demand for energy efficiency from businesses and residents alike, as energy costs spike.

Juniper Research defines a smart building as a structure that uses connectivity to enable the economical use of resources while creating a safe and comfortable environment for the employee occupants.

The new research study found that by enabling buildings to monitor and automate common functions, significant efficiency gains can be made while improving the environment for office workers.

Juniper's analysts recommend that IT vendors focus on building analytics platforms for the most value to be driven from smart infrastructure deployments.

According to the Juniper assessment, non-residential smart buildings will account for 90 percent of smart building spending globally in 2026 -- at a similar level to 2022.

This dominance is due to the larger economies of scale in commercial premises driving this spending, as well as the commercial focus of most smart building technologies.

"Smart building platform vendors will understandably focus on non-residential use cases, as these provide a stronger return on investment, but they should not neglect the importance of residential deployments, as environmental concerns intensify," said Dawnetta Grant, industry analyst at Juniper Research.

Outlook for Smart Building Applications Growth

The research found that the global shipments of sensors used in smart buildings will exceed 1 billion annually in 2026 from 360 million in 2022 -- representing a growth of 204 percent.

Sensors, when combined with intelligent management platforms, will allow smart buildings to adapt to current conditions; matching elements such as lighting, heating, and ventilation requirements.

Juniper analysts also recommend that smart building vendors partner with artificial intelligence (AI) vendors to maximize the benefits of IT automation, such as reduced energy costs and improved working environments.

That said, the COVID-19 pandemic caused millions of office workers to work from home. It brought displacement and cultural change to the traditional workplace. It also sped up the digital transformation revolution and thereby increased employee productivity. And yet, this disruption has only just begun.