The telecom marketplace continues to change as more CIOs and CTOs seek ways to improve voice services and cut costs. Moreover, the mobile telecom market has been prone to digital disruption, as voice over IP (VoIP) communication has evolved.

The use of fixed-line telephone services has declined steadily, while there have been significant increases in the use of mobile phone services, Wi-Fi calling services, and over-the-top (OTT) mobile voice.

Plus, the roll-out of superior mobile network connectivity modes -- such as 4G LTE, 5G, and in the foreseeable future, 6G networks -- will continue to transform the global communications market.

Mobile Telecom Market Development

The decline in fixed-line telephone services is reducing for a number of reasons, but it is primarily due to a significant increase in mobile phone and media tablet device ownership supporting data-intensive applications -- such as mobile games, mobile videos, and location-based services.

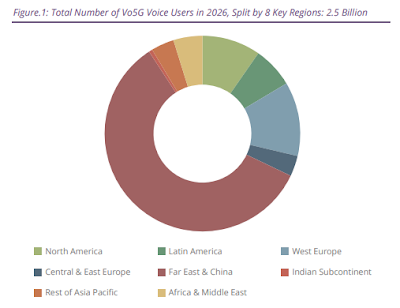

According to the latest worldwide market study by Juniper Research, the total number of Voice-over-5G users will reach 2.5 billion globally by 2026 -- that's rising from only 290 million in 2022.

This remarkable growth of 780 percent will be driven by the ongoing acceleration of 5G roll-outs following a slowing during the pandemic. Voice-over-5G leverages the software-based nature of 5G networks to offer APIs for business voice services over operator networks.

The new Juniper study findings urged mobile network operators to capitalize on the growth of Voice-over-5G users to create a new portfolio of voice services. They recommend that savvy operators prioritize interactive calling, intelligent call routing, and the integration of AI-based interactive voice response (IVR).

These applications provide the most immediate return on investment of Voice-over-5G. In particular, Juniper analysts have identified interactive calling as a key opportunity for mobile network operators who have launched 5G to provide more valuable voice services and compete with OTT voice apps.

Interactive calling leverages 5G networks to offer advanced voice calling functionality, including interactive content and screen-sharing, directly in the native calling app on smartphones, thus negating the need for third‑party applications.

Current 4G voice technology, Voice-over-LTE (VoLTE), is not sufficient to support interactive calling. While there are currently over 4.4 billion VoLTE users, representing over 50 percent of subscribers, the lower speed of 4G networks in comparison to 5G networks has thus far restricted the use of interactive features or AI in operators’ voice services.

Outlook for VoIP Communications Apps Growth

Despite the growth of Voice-over-5G, Juniper forecasts that operator-billed voice revenue will decline by 16 percent over the next four years, as more peer-to-peer (P2P) voice traffic migrates to third-party voice software apps.

Furthermore, Juniper urges mobile network operators to capitalize on the growth of 5G networks to develop new business‑oriented voice services -- such as interactive calling. 5G-based voice services must emulate operators’ current business messaging solutions by levying the cost on enterprises, rather than monetizing mobile subscriber usage.

That said, due to the COVID-19 pandemic, the wholesale voice communications industry has gained some significant traction, as the majority of enterprises and government agencies had to adapt to employees working from home. Flexible working models will continue to gain momentum.

I believe the economic disruption of an ongoing global pandemic has highlighted how essential and important the further development of telecommunications infrastructure is in keeping people, enterprises, governments, and societies connected in the coming years.