The leading organizations that create a digital transformation plan will gain the most from their use of public cloud computing. However, some CIO and CTO leaders still struggle with how to build a modern cloud migration strategy.

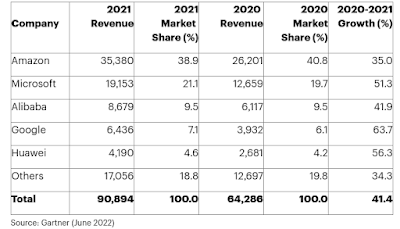

The worldwide cloud computing Infrastructure as a Service (IaaS) market grew 41.4 percent in 2021, to a total of $90.9 billion -- that's up from $64.3 billion in 2020, according to the latest market study by Gartner.

"The IaaS market continues to grow unabated as cloud-native becomes the primary architecture for modern workloads," said Sid Nag, vice president and analyst at Gartner.

Cloud IaaS Market Development

Cloud supports the scalability and composability that advanced technologies and applications require, while also enabling enterprise leaders to address emerging needs such as sovereignty, data integration, and enhanced customer experience.

In 2021, the top five IaaS providers accounted for over 80 percent of the market. Amazon AWS continued to lead the worldwide IaaS market with revenue of $35.4 billion in 2021 and a 38.9 percent market share.

Microsoft followed in the number 2 position with 21.1 percent share and above-market growth, reaching over $19 billion in IaaS revenue in 2021.

With many organizations already relying on Microsoft’s enterprise software and services, Azure has been positioned to capture opportunities across nearly every vertical industry sector.

Alibaba was again the number 3 IaaS public cloud provider worldwide with a 9.5 percent market share and revenue of $8.7 billion for 2021, primarily driven by growth in China.

While Alibaba continues to lead the Chinese cloud market, it is also poised to be the leading regional provider in Indonesia, Malaysia, and other emerging cloud markets, given its local market understanding and ability to serve as a bridge to digital commerce.

"Regional cloud ecosystems are becoming increasingly important amidst growing geopolitical fragmentation and emerging regulatory and compliance requirements, presenting an opportunity for providers with a strong regional presence," said Nag.

Google Cloud saw the highest growth rate of the top five IaaS cloud computing vendors, growing to 63.7 percent in 2021 to reach $6.4 billion in revenue.

This growth was driven by steadily increased adoption for traditional enterprise workloads as well as Google's innovation in more cutting-edge capabilities such as artificial intelligence and Kubernetes container technologies, supported by an expansion of their partner ecosystem to reach a wider customer base.

While Huawei's growth tempered in 2021 after two straight years of over 200 percent growth, it still maintained the number 5 market share position with $4.2 billion in revenue.

Huawei has made significant investments in its IaaS ecosystem in the past two years, and through an enhanced strategy of open hardware, open-source software, and partner enablement it has been able to provide expanded offerings for universities, developers, and startups.

Outlook for Cloud IaaS Applications Growth

"The next phase of IaaS growth will be driven by customer experience, digital outcomes, and the virtual-first world," said Nag.

Emerging technologies that can help businesses bring experiences closer to their customers, such as the metaverse, chatbots, and digital twins, will require hyperscale cloud infrastructure to meet growing demands for compute and storage power.

That said, more CHROs are updating their flexible working policies and then collaborating with the IT team to embrace public cloud solutions for most employees that require a secure digital workspace. A superior online employee experience is a meaningful competitive advantage in the tech talent marketplace, where the most qualified candidates are in high demand.