Fact: online payments are a prime target of cyber-criminals. There are millions of potential loopholes to exploit as payment card details are stored while processing routine online eCommerce transactions.

The Dark Web is where criminals interact without being traced. This is where fraudsters buy and sell payment card details and share information on how to steal funds, and the best tools to use.

From market data, it's clear that online retail payments are convenient. However, they've also created a playground for people intent on defeating the structures on which online payments rely.

Trust, it seems, is breaking down. Plus, the security threats continue to evolve and test anti-fraud measures.

Online Payment Market Development

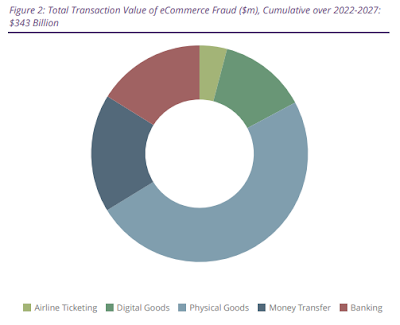

According to the latest worldwide market study by Juniper Research, the cumulative merchant losses to online payment fraud between 2023 and 2027 are forecast to exceed $343 billion.

As a comparison, this equates to over 350 percent of Apple’s reported net income in the 2021 fiscal year -- showing the massive extent of these financial losses due to fraud.

Online payment fraud includes losses across the sales of digital goods, physical goods, money transfer transactions, and retail banking -- as well as purchases such as airline ticketing.

Fraudster attacks can include phishing, business email compromise, and socially engineered fraud.

Online payment fraud losses are partly being driven by fraudster innovation in areas such as account takeover fraud, where a user’s identity and eCommerce-related account are hijacked.

This fraud is possible despite the wide employment of secure identity verification measures.

Juniper found that in order to combat rising online losses, fraud prevention vendors must orchestrate the right mix of verification tools, at the most effective point in the customer journey, to best protect users.

However, this orchestration progress will require significant new customizable online security capabilities.

"Fundamentally, no two online transactions are the same, so the way transactions are secured cannot follow a one-size-fits-all solution," said Nick Maynard, head of research at

Juniper Research.

Juniper analysts believe that payment fraud detection and prevention vendors must build a multitude of verification capabilities, and intelligently orchestrate different solutions depending on circumstances, in order to correctly protect merchants and users.

Outlook for Secure Online Payment Apps Growth

Juniper Research identified physical goods purchases as the largest single source of losses -- accounting for 49 percent of cumulative online payment fraud losses globally over the next 5 years, growing by 110 percent.

Lax address verification processes in developing markets are a major fraud risk, with fraudsters targeting physical goods specifically, due to their resell potential.

As such, Juniper analysts recommend that online merchants adopt the most effective anti-fraud measures -- including multiple sources of address verification and multi-factor authentication to reduce fraudulent incidents for physical goods merchants.

That said, I believe the shift to online eCommerce will continue unabated. New security technologies are constantly being introduced that make it more difficult for fraudsters to steal an individual's identity and gain access to their payment cards. Therefore, secure online payments are a growth market.