Available Internet access at an affordable cost is essential for everyone to participate in the Global Networked Economy. The deployment of fifth-generation (5G) wireless communications infrastructure is enabling the introduction of lower-cost broadband services in some markets.

Fixed Wireless Access (FWA) allows mobile network operators (MNO) to deliver high-speed Internet connections in areas that have either insufficient or no prior wireline broadband access services.

It's also used in urban, suburban, and rural areas where fiber optic communication is considered too expensive to install and maintain. With this new technology, MNOs have the potential to provide broadband capability at similar levels to fiber optic networks.

Fixed Wireless Access Market Development

Therefore, FWA can be used to supplement existing wired broadband Internet service offerings, provide additional broadband capacity, or act as a backup service for home or business applications.

Although FWA is well established in some markets, the advent of 5G is allowing for mobile technology to be intersected to meet the demands of fixed-line services at similar price points.

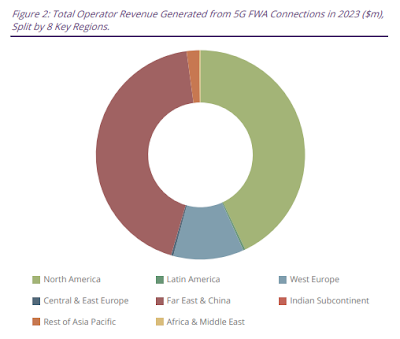

According to the latest worldwide market study by Juniper Research, total operator-billed revenue generated from 5G FWA services will rise from $515 million in 2022 to reach $2.5 billion next year.

This significant growth will be driven by 5G’s advanced network capabilities, such as ultra-low delay and increased data processing to provide connectivity services that were previously unachievable with 4G wireless technology.

FWA includes services that provide high-speed Internet connectivity through cellular‑enabled Customer Premises Equipment (CPE) devices for uses including broadband and Internet of Things (IoT) networks.

Juniper analysts predict that mobile network operator 5G FWA revenue will reach $24 billion globally by 2027. They identified the consumer market as the sector generating the highest revenue for operators -- representing 96 percent of global 5G FWA revenue.

However, they warn that mobile network operators must provide a compelling user proposition for FWA solutions through the bundling of services such as video streaming, gaming, and smart home security to enrich the user experience and gain a competitive advantage against incumbent Internet providers.

"The benefits of FWA are now comparable with services using fiber-based networks. Operators have an immediate opportunity to generate revenue from broadband subscriptions directly to end users by providing last-mile solutions underpinned by their existing 5G infrastructure," said Elisha Sudlow-Poole, research analyst at Juniper Research.

Outlook for FWA Revenue Growth Opportunities

Juniper's analyst also identified private networks as a key monetization opportunity, offering superior network capabilities over 4G wireless infrastructure capabilities.

Smart manufacturing, sea shipping ports, and airports are the key commercial use cases for 5G FWA services. Juniper recommends that mobile network operators use 5G FWA to facilitate the last mile-solution by treating the relationship between FWA and fiber networks as wholly collaborative to maximize network performance and the return on investment.

That said, I believe the 5G FWA technology is still in the early stages of performance validation, and the limits and reliability of the services have yet to be determined. Like all wireless technologies, there are a number of different environmental factors that can impact the quality of service.

The market tests thus far have delivered mixed results. The upside potential for revenue growth will be dependent upon future test results. Therefore, we'll continue to watch this space for new insights.