The GSM Association introduced the development of a new type of Subscriber Identity Module (SIM) which is directly soldered into a mobile device.

This eSIM (embedded SIM) could then be programmed to connect to a chosen mobile service provider's network profile via a process known as Remote SIM Provisioning (RSP).

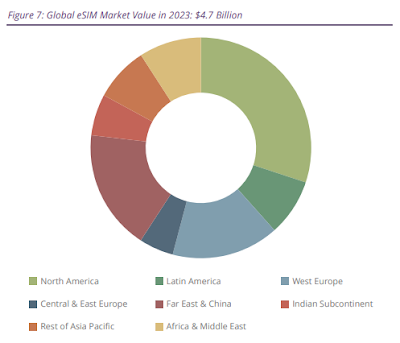

According to the latest worldwide market study by Juniper Research, the value of the global eSIM market will increase from $4.7 billion in 2023 to $16.3 billion by 2027.

eSIM Technology Market Development

Increasing by an impressive 249 percent, the market growth will be driven by the adoption of eSIM-enabled mobile devices, as seen in Apple’s recent release of the eSIM-only iPhone 14 smartphone -- driving accelerated mobile network operator support.

eSIMs are embedded within mobile devices, enabling devices and sensors to seamlessly switch between mobile network operator profiles.

Juniper analysts predict that Apple will expand the deployment of eSIM-only devices to Europe during 2023, with eSIM technology key to minimizing the time-consuming establishment of roaming agreements within the fragmented European mobile telecommunications market.

Juniper's study found that the total number of smartphones leveraging eSIM connectivity will increase from 986 million in 2023 to 3.5 billion by 2027, with manufacturers such as Google and Samsung developing an equivalent eSIM-only Android device in order to compete with Apple and maintain their global market dominance.

"Despite operator concerns regarding the disruptive impact of eSIMs on existing business models, growing support from smartphone manufacturers will place additional pressure on operators," said Scarlett Woodford, research analyst at Juniper Research.

In response, mobile service providers must support eSIM connectivity to avoid subscriber attrition as enhanced device technology awareness increases.

Juniper found that the total number of eSIM-connected smartphones in China will increase from 103 million in 2023 to reach 385 million by 2027, assuming country-specific mobile device standards are implemented to allow eSIM use in smartphones.

Outlook for eSIM Technology Regional Adoption

According to the Juniper assessment, current regulations prevent Chinese-based device manufacturers from selling to their home market, limiting eSIM technology investment and related innovation.

In response, Juniper urges leading industry authorities to work closely with the Chinese government to develop specifications that allow eSIM support while addressing requirements for device monitoring and tracking.

That said, I noted that there is a concern about how the cost of eSIMs compares to the cost of traditional SIM card solutions. Therefore, it's important to consider that in order to support eSIM technology, mobile network operators will need to invest in the required infrastructure.