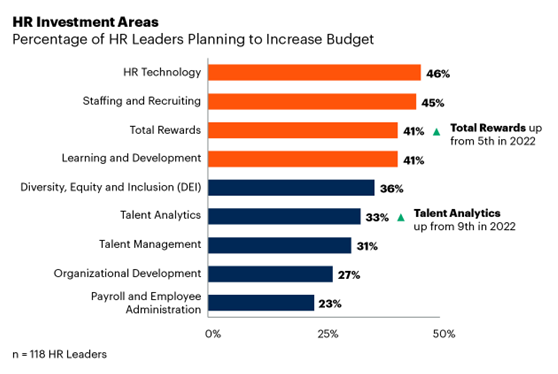

Nearly half of Human Resource (HR) leaders polled cited technology as their top investment priority. Gartner's latest survey revealed the other top investment areas for HR leaders in 2023 are staffing and recruiting, employee total rewards, plus learning and development.

HR leaders reported intense competition for skilled talent, and global candidate supply constraints. Instead of opting for simple cost-cutting measures, leading organizations are focusing on growth and determining which investments will drive competitive advantage in the year ahead.

To optimize costs and drive growth, HR leaders will act on a few key investment imperatives. HR technology can trigger cost savings in HR administration, which has seen a drastic uptick in cost due to pandemic-related tasks, and Remote or Hybrid work arrangements.

HR Technology Market Development

Gartner's research shows yearly spending on HR administration increased from $155 per employee in 2021 to $194 per employee in 2022. However, some HR functions have been trying to reduce the burden of administrative tasks through the use of digital transformation solutions.

According to the Gartner assessment, HR leaders can create efficiencies by implementing human-centric technology solutions -- such as skills management or learning experience platforms -- to maximize employee experience, retention, collaboration, and performance outcomes.

Meanwhile, many organizations face ongoing talent shortages as competition expands due to accelerated digitalization and the rapid adoption of flexible working initiatives. HR leaders are tasked with redefining hiring to access a larger international pool of skilled talent to meet hiring demands.

Leading organizations are investing in recruiting technology. To date, digitalization has pushed organizations to automate parts of the hiring process. HR leaders are now focusing their investments in all areas of the candidate pipeline, including candidate attraction, sourcing, as well as advanced data analytics.

Gartner predicts technologies with the most potential to aid recruiting operational excellence are artificial intelligence-enabled sourcing and screening capabilities, plus candidate relationship management platforms.

Furthermore, HR functions face the challenging task of providing additional financial support to employees affected by the rising cost of living, while avoiding a wage-price spiral.

The cost to acquire and retain skilled digital talent is significant for HR leaders, with survey respondents citing employee "total rewards" as the third-largest investment area for 2023 -- moving up from fifth in 2022.

Therefore, HR functions are boosting total rewards investments by focusing on equitable reward and recognition programs, pay transparency, and employee well-being programs.

This includes investments in areas such as compensation planning technologies, pay equity tools, or smart wearable technology to monitor employee stress and fitness levels.

"HR leaders must recognize that obligations, stressors and concerns from employees’ personal lives will reverberate in their working lives, potentially affecting performance and productivity," said Hanne Nieberg, director at Gartner.

Digital skills continue to change rapidly, requiring the HR Learning and Development (L&D) function to take on an expanded role in supporting employees’ expectations for a more human-centric employee experience.

However, L&D offerings are not keeping up with the pace of change. Gartner research shows less than half (45 percent) of employees agree the learning their organization provides is relevant to them.

Outlook for HR Learning and Development Apps

HR leaders must now shift their L&D investments towards whole career growth. Rather than focusing solely on current roles, they must think more broadly about a Growth Mindset that helps employees develop.

Increased digital learning applications and changing learning preferences provide an opportunity for L&D functions to invest more heavily in HR technologies that enhance skills management solutions, learning experience platforms with AI-enabled self-service learning options, and employee coaching.

"It’s about intentionally exploring where, how, and when employees learn -- as well as what impacts their ability to learn most effectively," concluded Nieberg.

That said, I believe competition for the most qualified digital business transformation talent will continue to drive up compensation packages for the top performers. At this time, there's no indication local talent supply will match the growing employer demand for these skills in the near future.

So, expect more employee retention disruption and churn. Also, anticipate the rise of the Global Talent Acquisition Manager role as more organizations perform an international search for their talent needs.