The Open Banking business model has been advantageous for Third-Party Providers (TPPs), helping them to extend their offerings into other areas of financial services with new capabilities.

Open Banking is also advantageous for traditional banking institutions, despite the perceived loss of custodianship over their data, by providing greater accessibility to more bank services.

Furthermore, Open Banking can help serve Mobile Internet providers that are able to leverage it to create tailored services according to customers’ preferences and/or economic limitations.

Open Banking Market Development

Since traditional banking services are made more convenient by TPPs via greater data access, customers can proactively manage their finances and shape the development of new financial offerings.

This is particularly noticeable in the realm of Digital Payments, where retail merchants and customers transact through eCommerce, which has the greatest number of use cases for Open Banking.

These include supporting new forms of currencies -- such as cryptocurrencies -- as well as other transaction mediums, such as digital wallets and digital credit or debit cards.

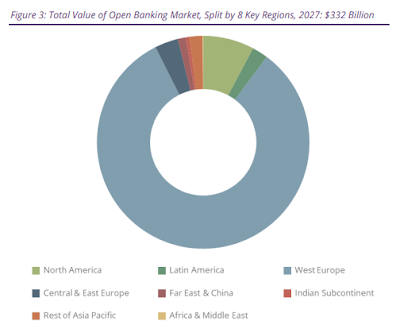

According to the latest worldwide market study by Juniper Research, Open Banking usage will grow by 470 percent over the next 4 years, with the total number of Application Programming Interface (API) calls to exceed 580 billion by 2027 -- that's up from 102 billion in 2023.

Strong interest in new Open Banking-based services, such as Personal Financial Management (PFM) tools and account access for underwriting for loans and credit, is driving this growth, as users seek to gain better control of their finances across different accounts.

Juniper analysts found that, given Open Banking’s low consumer awareness, infrastructure vendors must work with the wider ecosystem to fully educate users and ensure they understand the benefits that sharing data can bring.

Europe’s share of API calls is predicted to be 70 percent of the global total in 2027. Europe has the best-established set of API connections of any region, having deployed Open Banking rails as part of PSD2.

Deployments are now becoming more advanced and covering a greater number of banking services, such as credit cards or mortgages, creating new opportunities for fintech vendors to explore.

"Europe has led the way on Open Banking and is an example of how regulator-led approaches can stimulate innovation. As a well-established market, Europe’s growth rate will dip compared to others, but it will still serve as an innovation hub for Open Banking development," said Nick Maynard, head of research at Juniper Research.

Latin America’s number of API calls is set to grow by over 1,270 percent between 2023 and 2027 -- generating significant opportunities in the region. Broader access to APIs and stronger consumer awareness will drive growth, as well as additional roll-outs, such as within Colombia.

Outlook for Open Banking Applications Growth

Juniper Research recommends that fintech vendors get involved in the earliest stages of Open Banking roll‑outs in new countries, to maximize their early-mover advantage and gain new momentum.

That said, I believe the Open Banking growth trajectory will be fuelled by more positive support for API availability, and the alleviation of security concerns by government regulators.

Also, the proliferation of use cases around digital payments is likely to increase adoption, despite the perceived gap between financial information consent by customers and the actual use of such offerings.