Chatbots are now integrated within messaging software, mobile apps, websites and online services that use Digital Assistants as a form of communication. Chatbots can also be hosted on APIs in a variety of digital channels such as Over-the-Top messaging apps and telecom provider Rich Communications Services platforms.

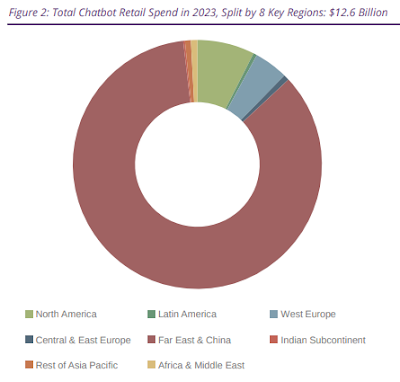

According to the latest worldwide market report by Juniper Research, global retail spend over chatbots is forecast to reach $12 billion in 2023 -- that's growing to $72 billion by 2028.

AI Chatbot Market Development

Increasing by 470 percent over 5 years, much of this growth will be driven by the emergence of cost-effective open language models, most notably ChatGPT, in regions such as North America and Europe.

Open language models consist of large neural networks that are trained on substantial quantities of online information and learn through low levels of human supervision.

According to the Juniper assessment, they are implemented into chatbots to automate functions such as customer support, marketing and payment processing.

Juniper analysts predict that the development of open language models will become a key driver for retail spend growth among small and medium retailers that were previously unable to invest in chatbots.

"Chatbots have historically been a low priority for omni-channel strategies owing to the high cost of training AI-based algorithms," said Frederick Savage, industry analyst at Juniper Research.

However, ChatGPT has significantly disrupted this trend, thereby lowering the cost of implementation of AI chatbots for smaller traditional or online retailers.

Additionally, Juniper forecasts the Asia Pacific region will account for 85 percent of global retail spend over chatbots, despite the region only representing 53 percent of the global population.

Mobile messaging apps -- including WeChat, LINE and Kakao -- have built strong partnerships with a wide array of online retailers, resulting in high levels of confidence in chatbots as a retail channel.

However, Juniper's analysts also predict that the release of open language models will drive growth outside of the Asia Pacific region.

By 2028, Juniper says that 66 percent of spending is forecast to be attributable to the region, as online retailers in other areas, such as North America and Europe, implement chatbots into retail activities.

To maximize this growth outside of the Asia Pacific region, Juniper analysts urge IT software vendors and telecom service providers to target online retailers in these two regions experiencing growth.

That said, I believe smaller retailers with modest budgets and simple customer demands will find a use for chatbots, with basic tasks and eCommerce processes.

These are usually the sort of chatbots that facilitate customer self-service, since these routine tasks are more likely to be automated. Therefore, the retailer chatbot market is an emerging sector to watch.