Digital wallets are a rapidly growing segment of the fintech market, which has accelerated since the global COVID-19 pandemic. They're important in the fields of financial inclusion, and movement towards a cashless Global Networked Economy.

There are many types of digital wallets, fulfilling different use cases.

Digital wallets enable users to pay for both online and offline transactions via either stored payment credentials -- such as debit cards, or currency stored in the wallet -- by utilizing apps on smartphones and mobile wearables.

Digital Wallet Market Development

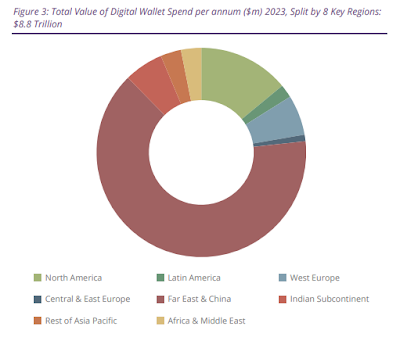

According to the latest worldwide market study by Juniper Research, the total value of digital wallets transactions will rise from $9 trillion in 2023 to surpass $16 trillion in 2028 -- that a CAGR of 77 percent.

This trend is driven by growth across both developed and developing markets across the globe, as the increased adoption of advanced services such as Buy Now Pay Later (BNPL), micro-loans, and personal financial management drives end-user engagement.

The Juniper study found that in a highly congested wallets landscape, diversifying their appeal to users is vital to continued adoption and growth.

A digital wallet is a software-based system that can act as a storage mechanism for a user’s payment, identity, loyalty, or ticketing information.

Juniper's analyst identified advanced services as a key source of revenue growth for digital wallets. These services, such as BNPL or microloans, are allowing digital wallet providers to diversify their revenue.

The popularity of BNPL, especially among younger customers, will draw greater numbers of people to use these offerings, and generate additional revenue.

This market development approach can be seen with Apple’s roll-out of numerous add-on services, including Apple Pay Later.

"Advanced services give digital wallet providers an opportunity to differentiate themselves in a congested market and generate additional revenue. Super app strategies, which many digital wallets are pursuing, will rely on the effective deployment of advanced services at scale," said Michael Greenwood, research analyst at

Juniper Research.

Juniper's assessment also found that security benefits are a key driver of digital wallet use in eCommerce within developed markets.

Many consumers do not wish to enter card information online. With digital wallets, this issue is reduced, as tokenization enables card and other payment information to be used in a highly secure way.

The research also identified that as digital wallets become broader, including elements of digital identity, convenience will play a greater role; enabling wallet services to act as more of an all-inclusive app for financial well-being.

Outlook for Digital Wallet Applications Growth

Across all markets, there is a general trend towards a more cashless economy. In some cases, this is actively encouraged by governments, while in others, this is a natural result of the adoption of mobile payment technology.

Another factor in this is the growth of smartphone penetration, with the majority of individuals globally having access to a smartphone. Indeed, smartphone penetration rates were at 68 percent in 2022, and are forecast to reach 80 percent by 2028, according to Juniper Research data.

That said, I believe there's a broad range of fintech competitors that will enter the digital wallet marketplace over time. Therefore, digital wallet providers should look to leverage the advantages of digital wallets over existing payment methods in their respective markets, in order to increase adoption and usage.