eCommerce is a major growth engine of the Global Networked Economy. It experienced an economic boost as a result of the COVID-19 pandemic. At the same time, the continued shift of commercial and consumer transactions has contributed to even greater upward momentum.

There are several trends that are driving the growth of global eCommerce. These include the rise of social commerce, the increasing importance of mobile commerce, and the growing popularity of cross-border shopping.

Global eCommerce Market Development

Social commerce is enabled by the use of social media platforms to sell products and services. This trend is growing rapidly, as more people are using the channel to discover, learn about and consider new offerings.

Mobile commerce is the use of mobile devices to shop for new products and services online. This trend is also growing rapidly, as more people are using their smartphones and tablets to shop for a variety of items and complete purchase transactions.

Cross-border shopping is the practice of buying products from online retailers in other countries. This trend is growing too, as more people are becoming experienced with online international shopping.

According to the latest worldwide market study by Juniper Research, the global number of unique eCommerce users will reach 4.4 billion by 2027 -- that's growing from 3.1 billion in 2022.

The research predicts that countries in Asia Pacific will be key drivers of this growth and will account for over 70 percent of these new global eCommerce users.

Specifically, the research identified Bangladesh, Pakistan and India as countries that will add over 600 million new eCommerce users alone over the next five years as increased Internet access and more comprehensive retail supply chains support growth.

Juniper's analysts predict that Asia-Pacific will provide significant opportunities for payment service providers such as Visa and Mastercard through increased eCommerce activity.

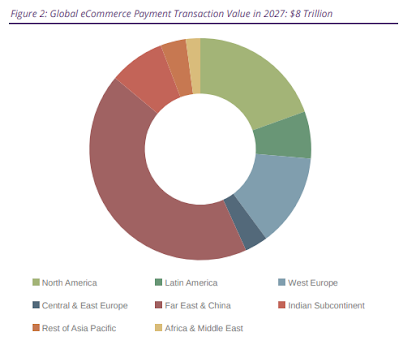

Looking ahead at the growth potential, it forecasts that the Asia-Pacific region will account for over $4.3 trillion worth of online and mobile retail spend by 2027.

To capitalize on this substantial growth, Juniper urges payment service providers to develop open payment platforms that can simplify eCommerce in emerging countries such as India and Bangladesh.

"Open payment platforms are key to maximizing growth in the region. They allow the swift implementation of country-specific payment preferences, such as domestic digital wallets, through integrated vendors and payment service providers; simplifying the eCommerce market for both merchants and consumers," said Cara Malone, industry analyst at Juniper Research.

Juniper's analysts also urge merchants to focus on metrics like increasing average spend and transactions per user, as access to eCommerce services proliferates across the Asia-Pacific region.

Outlook for Asia-Pacific eCommerce Applications Growth

According to the Juniper assessment, merchants must implement artificial intelligence (AI) based sentiment analysis tools to identify consumer preferences and thereby achieve this application growth.

Merchants who provide personalized eCommerce experiences and offers will be best positioned to capitalize on the growth of eCommerce in Asia Pacific markets.

However, Juniper cautions that early-mover advantage will be key to gaining the wealth of transactional information needed to launch personalized experiences as early as possible.

That said, I believe the growing popularity of online marketplaces, which make it easier for merchants to sell their products and services to a wider addressable market, will be a key factor driving growth.