Global demand for public cloud computing services continue to grow. Worldwide revenue for the public cloud services market totaled $545.8 billion in 2022 -- that's an increase of 22.9 percent over 2021, according to the latest worldwide market study by International Data Corporation (IDC).

Software as a Service (SaaS) applications continued to be the largest source of public cloud services revenue by far, accounting for more than 45 percent of the total in 2022.

Infrastructure as a Service (IaaS) was the second largest revenue category with 21.2 percent of the total, while Platform as a Service (PaaS) and Software as a Service System Infrastructure Software (SaaS SIS) delivered 17 percent and 16.7 percent respectively.

Public Cloud Services Market Development

"Given the economic challenges of the past year, it's easy to conclude that we are in a period where a focus on constraining new expenditures and optimizing the use of existing cloud assets will dominate CIOs' priorities and shape the fortunes of IT providers for the next several years," said Rick Villars, group vice president at IDC.

But that's the wrong conclusion. The assessment and use of Artificial Intelligence (AI), triggered by Generative AI, is starting to dominate the planning and long term investment agendas of businesses and cloud providers, which will drive new growth.

Spending with the leading providers of public cloud services further consolidated in 2022, with the combined revenue of the top five public cloud service providers -- Microsoft, AWS, Salesforce, Google, and Oracle -- capturing more than 41 percent of the worldwide total and growing 27.3 percent year-over-year.

With offerings in all four deployment categories, Microsoft remained in the top position in the overall public cloud services market with 16.8 percent share in 2022, followed by AWS with 13.5 percent share.

While the overall public cloud services market grew 22.9 percent year over year in 2022, revenue for foundational cloud services that support digital-first strategies saw revenue growth of 28.8 percent.

This highlights the increasing reliance of enterprises on a cloud innovation platform built around widely deployed compute services, data or AI services, and app framework services to drive innovation.

IDC expects spending on foundational cloud services -- especially IaaS and PaaS elements -- to continue growing at a higher rate than the overall cloud market as enterprises leverage cloud to accelerate their shift toward digital business models.

"Cloud providers are making significant investments in high-performance infrastructure," said Dave McCarthy, research vice president at IDC. "This serves two purposes."

First, it unlocks the next wave of migration for enterprise applications that have previously remained on-premises. Second, it creates the foundation for new AI software that can be quickly deployed at scale. In both cases, these investments are resulting in market growth opportunities.

IDC research shows that most organizations rank their public cloud provider as their 'most strategic' technology partner, with general agreement among IT leaders and business leaders.

When it comes to planning for PaaS developer and data services, organizations that haven’t yet begun their journey in developing AI-enabled applications are beginning to prioritize them now.

Those that have already started to adopt AI are finding themselves well positioned to evaluate further adoption of Generative AI application capabilities in an intelligent app strategy.

SaaS applications remain the largest segment of the more than $547 billion cloud software market forecast by the end of 2023. Changing market conditions, exponential increases in cloud service spend, and rapid cadence of supplier innovation help sustain double-digit growth.

The next generation of SaaS applications will leverage advances in AI to deliver unprecedented performance improvements in personalized services or customer experience, and operational efficiency while redefining functional markets across industries.

Outlook for Public Cloud Applications Growth

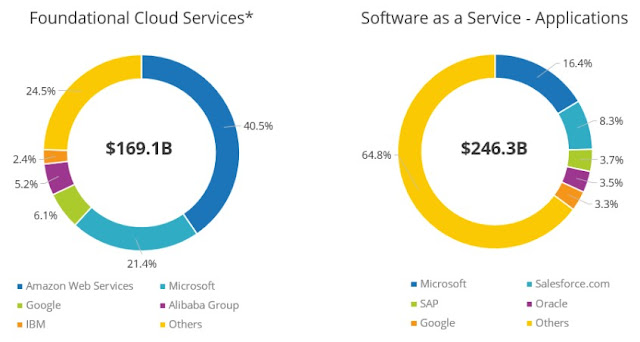

While both the foundational cloud services market and the core SaaS applications market are led by a small number of companies, there continues to be a healthy long tail of specialized providers delivering value-added cloud services around the globe.

In the foundational cloud services market, the five leading companies account for three quarters of the market's revenues with targeted use case-specific PaaS services or cross-cloud compute, data, or network governance services.

According to the IDC assessment, the long tail is more pronounced in the SaaS applications market, where customers' growing focus on specific business outcomes ensures that nearly two thirds of the spending is captured outside the top five providers.

That said, I believe more executive leadership teams in large enterprise organizations will continue to seek out deep domain expertise in most of the major industry sectors. Moreover, those cloud SaaS providers that are able to offer specialized professional services will gain new momentum.