Generative AI (GenAI) has captured the imagination of business leaders and IT decision-makers around the world, and many are seeking information and guidance as they begin their journey.

Artificial Intelligence (AI) spending in Europe will reach $34.2 billion in 2023 -- that's 20.6 percent of the worldwide AI market, according to the latest global study by International Data Corporation (IDC).

AI investment in Europe will post a 29.6 percent compound annual growth rate (CAGR) between 2022 and 2027, slightly higher than the worldwide CAGR of 26.9 percent for the same period, with spending expected to exceed $96.1 billion in 2027.

Enterprise AI Market Development

Enterprise AI solutions are becoming increasingly widespread, driven by operational efficiency and IT operational optimization needs, as well as to provide improved customer experiences.

IDC identified augmented threat intelligence and prevention systems, together with augmented fraud analysis and investigation, as prevalent AI use cases, particularly in the finance sector and in more threat-exposed industries such as telecom or central and local government.

Improved customer experience and enhanced sales processes are delivered through use cases such as augmented customer service agents and sales process recommendation and augmentation -- primarily in the retail sector and, to a lesser extent, in banking.

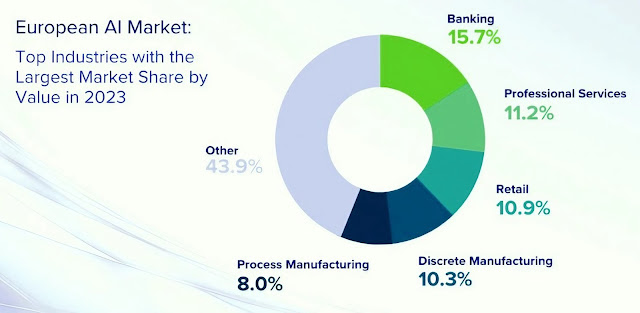

Banking, professional services, retail, manufacturing, and telecom are the biggest AI industries, accounting for more than 60 percent of total European AI market spending in 2023.

While spending in other industries such as healthcare, media, personal and consumer services, and utilities is smaller, it is growing at a higher-than-average pace.

In an uncertain economic environment, where inflation is playing a key role in investment decisions, IDC believes the AI market is still growing, supported by rapid demand for GenAI solutions.

"GenAI is gaining attention from vendors, consumers, and businesses, raising questions that range from how to embed the technology in products and how to benefit most from its usage to how to ensure responsible usage, given such widespread demand," said Carla La Croce, research manager at IDC.

IDC believes that the fastest-growing GenAI use case is image creation, which is widely used in media and marketing activities, followed by text creation, particularly in professional services.

"Spending on GenAI use cases is still lower than for more well-established AI use cases, but it is growing rapidly. The creation of images, text, and videos are the most common use cases, with the greatest growth over the last year," according to La Croce.

Companies are racing to enhance existing applications with AI features, while more forward-looking and innovative vendors are embedding GenAI in their solutions to meet increasing demand.

Outlook for Generative AI Apps Growth

The next step in the journey to GenAI apps growth is an identified set of use cases. IDC defines a use case as a business-funded initiative enabled by technology that delivers a measurable business outcome.

The three types of enterprise GenAI use cases:

Industry: These involve work that may require organizations to build their own GenAI models. Examples include drug discovery in life sciences and material design for manufacturing. They are built around specific models, with custom integration architectures designed for individual clients.

Business Function: These involve integrating models with corporate data for use by specific departments or business functions, such as marketing, sales, and procurement. Organizations are testing these types of use cases, but are concerned about intellectual property leakage and data governance.

Productivity: These involve work tasks, such as summarizing reports, creating job descriptions, or generating Java code. GenAI functionality for productivity improvement is being infused into existing business apps. For many, value can be delivered through the content and data from training models.

That said, I believe that business strategy should be the deciding factor driving the selection of use cases that are most likely to result in achieving desired business outcomes and a return on investment.