The cost of legacy Marketing Technology (Martech) automation is rising. The number of isolated systems is growing, and the benefits are questionable. Marketers are now struggling to justify the expense, when they cannot demonstrate a compelling ROI.

Chief Marketing Officers (CMOs) are under pressure from their C-suite to reassess their investment in legacy automation and consider alternative solutions that will deliver net-new digital growth results.

Marketing Automation Market Development

Sixty-three percent of marketing leaders are already planning to invest in Generative AI solutions in the next 24 months, according to the latest worldwide market study by Gartner.

Slightly more than half of Gartner survey respondents (56 percent) see greater reward than risk in the adoption of modern Generative AI systems.

The Gartner survey of 405 marketing leaders revealed the user utilization of their organization's overall current Martech stack’s capability has dropped to just 33 percent on average in 2023.

This Martech utilization reduction marks the second consecutive year of decline -- 42 percent in 2022 and 58 percent in 2020.

Meanwhile the investment focus has shifted to new artificial intelligence (AI) offerings. "CMOs recognize both the promise and challenges of Generative AI," said Benjamin Bloom, vice president at Gartner.

There’s a clear tension between investing more in the legacy Martech stack to drive utilization, or reallocating their finite resources towards GenAI applications that may not suffer from the same utilization problems.

Gartner’s 2023 CMO Spend and Strategy Survey found that organizations are spending 25.4 percent of their 2023 marketing budget on aging technology solutions.

With the sharp decline of legacy Martech utilization, cost optimization pressure will be unavoidable upon recognition that marketers use only a third of these technology capabilities that consume a quarter of their entire marketing budget.

By contrast, for the few organizations that use more than 50 percent of their Martech stack, they are significantly less likely to report being asked to cut their Martech budget. Clearly, CMOs can do better.

Increasing an organization’s Martech utilization is difficult: Just 11 percent of Gartner's survey respondents reported increasing their utilization of current solutions by more than 10 percent in 2023, compared to 12 months ago.

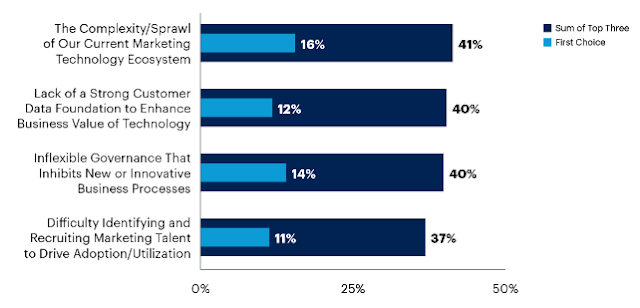

Complexity of the current fragmented product ecosystem, customer data challenges, and inflexible governance were identified by survey respondents as the most common impediments to greater utilization of their Martech stack.

"Marketers tend to acquire new technologies without a systematic approach for adopting them," said Bloom. "Combined with multi-year contracts, under-utilized or abandoned technology can easily result in an unwieldy stack over time."

Outlook for Marketing Automation Spend Transformation

According to the Gartner assessment, savvy enterprise CMOs should press Martech teams to find opportunities to simplify so the rest of the function can flourish. That requires a change in approach.

Cutting underused marketing technology within the current stack can also preserve some 'dry powder' for transformative applications that are beginning to emerge. That's the upside opportunity for a GenAI-enabled radical transformation.

That said, in my experience, legacy Martech automation can be complex and time-consuming to implement. This support can require a significant investment of time and resources from both the IT team and the marketing leadership, which can be a huge deterrent for forward-thinking marketers. Therefore, a change in investment strategy is wise.