Unlike traditional mobile communication ecosystems, an emerging market will be defined by the entrance of a new category of service providers, satellite vendors.

These vendors will work with telecom network operators to deploy Non-Terrestrial Networks (NTNs) that are utilized alongside terrestrial networks.

They are a joint development between terrestrial network operators and satellite vendors. In the future, NTNs will integrate directly with satellite-based networks to provide combined connectivity services.

5G Satellite Network Market Development

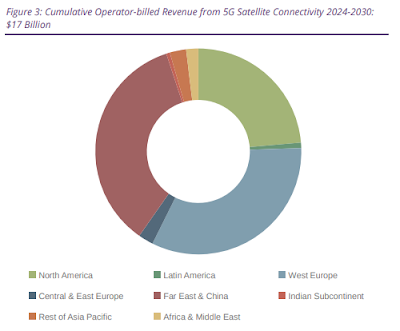

According to the latest worldwide market study by Juniper Research, network operators will generate $17 billion of additional revenue from Third-generation Partnership Project (3GPP) compliant 5G satellite networks between 2024 and 2030.

Juniper has urged terrestrial network operators to sign partnerships with Satellite Network Operators (SNOs) which will enable operators to launch monetizable satellite-based 5G services to their subscribers.

SNOs possess the capabilities to launch next-generation satellite systems into space, as well as being responsible for the operation and management of the resulting integrated networks.

The research findings predict that the first commercial launch of a 5G satellite network will occur in 2024, with over 110 million 3GPP‑compliant 5G satellite connections in operation by 2030.

To capitalize on this growth, Juniper analysts also urge operators to prioritize immediate partnerships with SNOs that can launch geostationary orbit satellites. These satellites follow the rotation of the earth to always be located above the country that the operator serves, providing consistent connectivity.

Additionally, terrestrial network operators must leverage their pre-existing billing relationship with mobile subscribers and enterprises as a platform to grow 5G satellite connectivity revenue over the next seven years.

Juniper anticipates that this existing billing relationship will enable mobile operators to rapidly drive the adoption of satellite connectivity by integrating satellite services into existing terrestrial networks.

However, they anticipate that mobile network operators will increasingly rely on SNOs for service provision as sixth-generation (6G) mobile technology development accelerates.

Outlook for 5G Satellite Network Applications Growth

"Operators must not only think of 5G satellite services when choosing an SNO partner, but also the forward plan for 6G networks, including coverage and throughput capabilities," said Sam Barker, vice president at Juniper Research.

That said, I believe satellites will provide coverage to areas where terrestrial networks are not viable. This matters in rural areas where there is insignificant demand for cellular connectivity, leaving mobile operators with little return on investment for the required backhaul infrastructure and base stations.

However, I've witnessed how traditional incumbent satellite vendors and Satcom service providers have struggled with a viable business model that enables them to operate profitably in rural markets. Operations cost-containment will be a key ingredient of success.